Groww is sponsored by marquee speculators including Ribbit Capital, Y Combinator, Sequoia Capital, Kauffman Fellows Fund, Collin West, Propel Ventures Partners, Yinglan Tan, Cipher Capital, Insignia Ventures Partners, and Mukesh Bansal, Co-originator of Myntra and Curefit.

The COVID-19 pandemic has elevated vulnerability over everything – our wellbeing, the economy, work, and funds. Be that as it may, this may likewise be an extraordinary opportunity to at last beginning putting resources into value markets to ‘develop’ your cash. While there are a lot of applications to allow you to investigate and put resources into the financial exchange, Groww, another age speculation application, lets individuals with DIY ventures with the tap of a catch

Groww is a simple demat and stock trading app that allow you to open a demat account and trade on BSE and NSE listed shares in zero brokerage on investment. In addition to mutual funds and stocks, Grove has also allowed people to invest in US stocks and gold.

Fused in 2016, Bengaluru-based Groww was begun by four ex-Flipkart heads – Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal to assist clients with putting resources into shared assets straightforwardly. From that point forward, it has developed amazingly, and has picked up clients just as speculators’ trust. Groww is sponsored by marquee speculators including Ribbit Capital, Y Combinator, Sequoia Capital, Kauffman Fellows Fund, Collin West, Propel Ventures Partners, Yinglan Tan, Cipher Capital, Insignia Ventures Partners, and Mukesh Bansal, Co-organizer of Myntra and Curefit.

Read also Sonu Sood’s Pravasi Rojgar receives $ 34 million from Goodworker

The application has been downloaded more than 5 million times on the Google Play Store and has been appraised 4.5 stars from clients. The application is accessible on Apple’s App Store also, and apparently has an aggregate of 8 million clients on the stage.

Simple to use Groww App

The application’s invite screen clarifies that the application is straightforward, simple to-utilize, and allowed to contribute. To begin utilizing the application, clients need to join with their Google account or some other email id. It is a one-tap join measure, and the application naturally distinguishes your telephone number and allows you to proceed. In the wake of marking in, one can likewise make a four-digit pin to bolt the application, which adds an additional layer of security to its clients.

The application has one-time e-KYC or paperless record opening system, which requests subtleties, for example, your PAN, Aadhaar card, and photograph, and your record is prepared to use in a couple of taps. In the event that your Aadhaar isn’t associated with your versatile number, at that point you can at present proceed with the cycle with a fast archive check from your telephone camera or you can transfer from the telephone exhibition. Nonetheless, it requests a last virtual sign, and in the event that you don’t have a virtual ID, at that point you may need to messenger a structure with your mark

We were unable to finish the KYC while auditing the application, and consequently couldn’t give our hands a shot exchanges. In any case, other than that, we could investigate Groww, and how one can do the exchanges by purchasing and selling stocks, common assets (methodical speculation plan (SIP) or one-time), and gold.

Easy to Buy and sell on Groww App

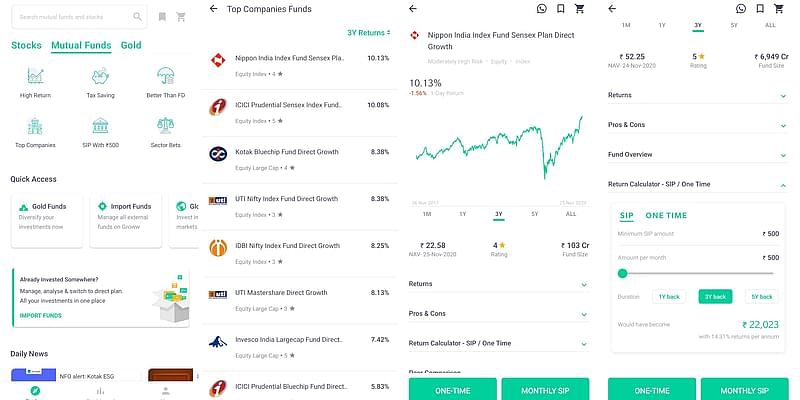

The home screen has three tabs on the top – stocks, shared assets, and gold. At the point when you tap common assets, you can investigate an assortment of assets across classes, and can likewise investigate why one ought to put resources into shared assets. The application has some brilliant tabs like area centered wagers, charge sparing assets, and SIP with Rs 500. A client can likewise observe shared assets with best yields, top organizations, and assets with low dangers named as in a way that is better than FD in the application. The application records supports like SBI Mutual Fund, Reliance Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund, Aditya Birla Sun Life (ABSL) Mutual Fund, Franklin Templeton Mutual Fund, DSP Blackrock Mutual Fund, Kotak Mutual Fund, etc.

Security features in Groww App

The application creators have guaranteed the clients feel made sure about while utilizing the application. For example, each time you leave the application page, you need to punch in the security code to sign in once more. The application producers state that Groww is made sure about with 128-cycle SSL Encryption, which is supposed to be a significant level encryption standard for its exchanges, which makes Groww as protected as a bank.