New to budgetary trade? I will take you through the universe of offer market in this article. First thing, let us understand what is share showcase? Offer promote is the spot buying and selling of offer happens. Offer addresses a unit of duty regarding association from where you got it.

For example, you bought 10 bits of Rs. 200 all of ABC association, by then you become a financial specialist of ABC. This empowers you to sell ABC share at whatever point you need. Placing assets into shares empowers you to fulfill your dreams like progressed training, buying a vehicle, creating a home, etc.

If you begin contributing at a young age and stay contributed for a long time, the movement of return will be high. You can plan your theory procedure reliant on the time you need money.

By buying share, you are placing money in the association. As the association creates, the expense of your offer likewise will augment. You can get advantage by selling the proposals on the lookout.

There are various components that impact the expense of an offer. On occasion the expense can rise and to a great extent it can fall. Long stretch endeavor will discredit the fall in cost. Why at all an association sells it offers to general society? An association requires capital or money for its augmentation, headway, etc and along these lines it raises support from open.

The system by which association issues shares is called Initial Public Offer (IPO). We will scrutinize logically about IPO under Primary Market.

Read also E-sports gaming platform GoodGamer brings $ 2.5M up in seed round

You would have continually heard people talking about emphatically moving business area and bear exhibit. What right? Emphatically moving business area is one where the expenses of stocks keep rising and the bear promote is the spot the costs keep falling. Where all these buying and selling happens? NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

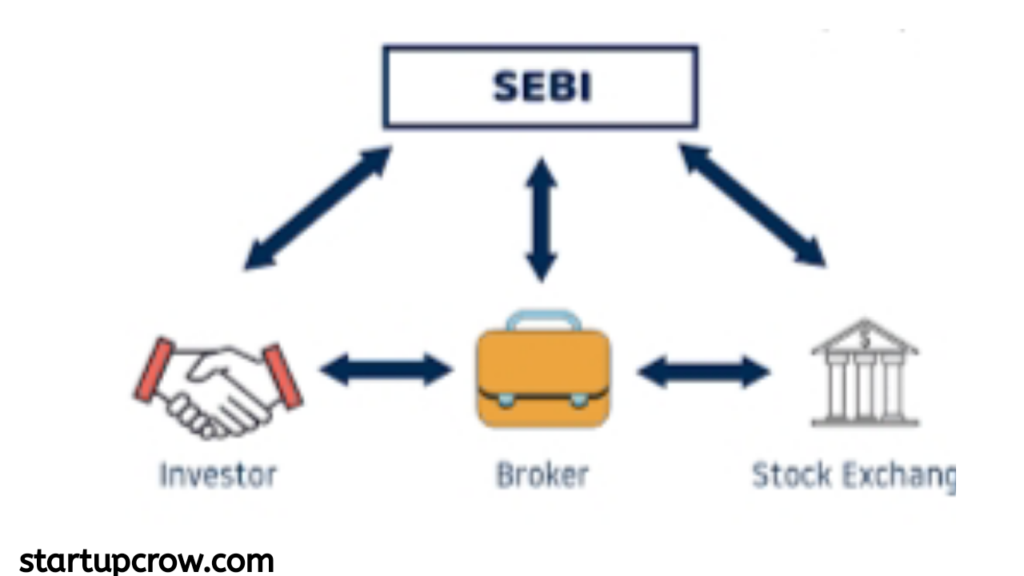

These are the two huge stock exchanges India and are overseen by SEBI (Securities and Exchange Board of India). Operators go probably as an arbiter between the stock exchange and the monetary authorities.

So to start contributing or trading, you have to open a demat record and trading account with a delegate. You can online successfully through a direct system. In the wake of associating your money related offset with these records, you can start your investment.

How does the financial exchange work?

The thought driving how the monetary trade capacities is truly direct. Working a ton of like a trading house, the protections trade engages buyers and sellers to orchestrate expenses and make trades.

The money related trade works through an arrangement of exchanges — you may have thought about the New York Stock Exchange or the Nasdaq. Associations list bits of their stock on an exchange through a methodology called a first offer of stock, or IPO. Monetary authorities purchase those offers, which empowers the association to gather pledges to build up its business.

Monetary masters would then have the option to buy and sell these stocks among themselves, and the exchange tracks the market enthusiasm of each recorded stock. That natural market help choose the expense for each security, or the levels at which monetary trade individuals — examiners and vendors — are anxious to buy or sell.

PC estimations all around do most of those calculations. Buyers offer an “offer,” or the most vital whole they’re willing to pay, which is normally lower than the entirety sellers “ask” for consequently. This qualification is known as the offer ask spread.

For a trade to occur, a buyer needs to grow his expense or a vendor needs to decrease hers. » Learn dynamically about how to place assets into stocks Evidently, stock trades probably happened a physical business place. These days, the protections trade works electronically, through the web and online stockbrokers

Each trade happens on a stock-by-stock reason, anyway as a rule stock expenses every now and again move couple because of news, political events, money related reports and various variables.

I hope that you will find the solution of What is really an offer market and how it functions?