At last, Govt of India has give the green sign to Whatsapp to reveal their Whatsapp Pay highlight, utilizing UPI as the stage.

In the primary stage, 2 crore Indian clients will have the option to utilize Whatsapp Pay through their application.

Whatsapp Pay will be Live In India soon

NPCI or National Payments Corporation of India, which runs and controls UPI has given the green sign to Whatsapp for dispatching their Whatsapp Pay administrations in India.

Whatsapp Pay will deal with UPI stage, and will utilize a multi-bank model. ICICI Bank has been affirmed as one of the banks which will uphold and empower Whatsapp Pay.

Read also Svish – The first company start to sell India’s First No…

At first Only 2 Crore Users Will Get Whatsapp Pay feature

In the first eliminate of move, NPCI has permitted just 2 crore Indian clients to get Whatsapp Pay highlight, and use it.

There are in excess of 40 crore clients of Whatsapp in India, and everybody will be in the end have the option to utilize Whatsapp Pay for making moment installments to their contacts, through UPI stage.

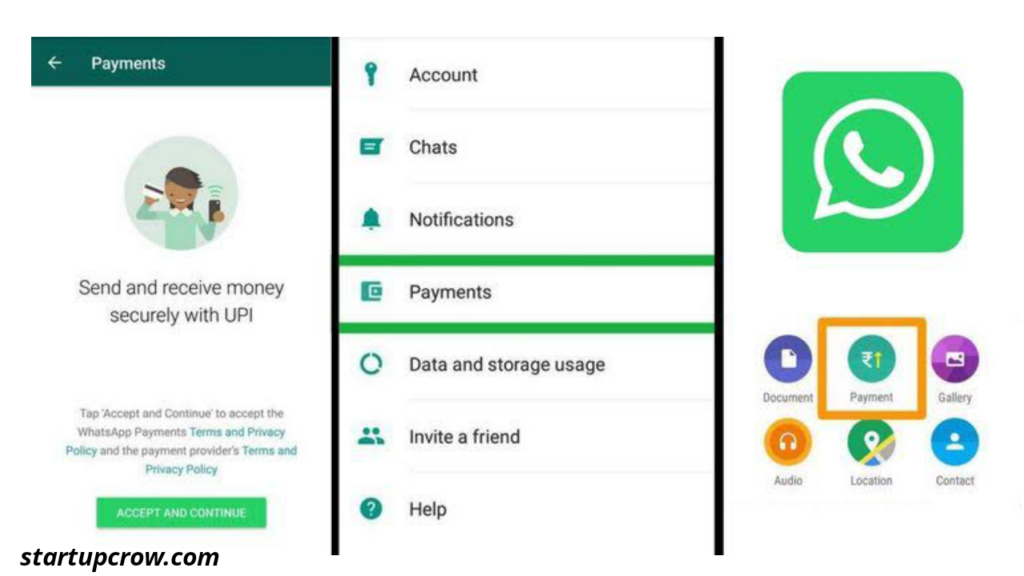

How To Send Money by Using Whatsapp Pay?

To check in the event that you have gotten Whatsapp Pay feature or not, click the menu on the home screen (upper right, three vertical dabs).

You will get Payment options.

In the event that you have this choice, at that point you should add your bank, check and affirm.

When the bank has been added, you can open any talk window, click on the Clip symbol, and enter the sum, UPI pin, and move the cash.

Sending and accepting Money by means of WhatsApp is exceptionally clear. The installments alternative shows up straightforwardly in the discussion window, and moving cash (or mentioning it) is as consistent as it can get:

- Select the contact you want to send money to.

- In the conversation window, select the clip icon.

- Choose Payment.

Select the amount you’d like to send (you can also add a note).

Enter your UPI PIN.

You’ll see a confirmation message show up directly in the conversation window once the transaction is done.

It’s as simple as that. The way that WhatsApp presently lets you make UPI exchanges inside the application is a colossal arrangement, and it makes sending and accepting cash from your contacts simpler than at any other time.

NPCI’s 30% Capital Rule On UPI Payments

Strangely, the day NPCI permitted Whatsapp to reveal their installments, NPCI has likewise forced a 30% cap rule on all UPI exchange done on the UPI applications. This implies that this 30% cap will be forced on Whatsapp also. What’s more, on the off chance that we look from another point, this 30% principle will assist Whatsapp Pay with picking up traction on the lookout, in a brief timeframe